Pulse by Asopo

Finance wasn’t designed for the last mile. We built Pulse to change that

In the world’s fastest-growing economies, mobile money is disconnected, asset financing is risky, and credit is hard to scale.

Pulse integrates operations, payments, credit scoring, and customer management in one seamless, modular system.

One Platform. All the Tools to Scale Frontier Finance.

Streamline mobile money. Eliminate payment chaos

Pulse connects with top mobile money operators and supports USSD payments. Track all incoming payments in real time, even across multiple branches.

Asset Lifecycle Management

Every asset. Every market. Always under control.

Lock, track, and redeploy financed devices. Pulse minimizes loss and maximizes asset ROI at scale.

Agent & Field Team Productivity

More field, less friction.

Tools for onboarding, swaps, collections, and offline sales; so your agents can keep selling, even without a signal.

AI-Powered Credit & Customer Intelligence

Lend smarter. Serve faster.

Behavioral scoring, pre-screening from statements data, and smart customer summaries help you reduce default, accelerate approvals, and support customers with context.

Flexible Finance & Repayment Models

Finance that adapts to your customer, not the other way around.

PAYGO, SME loans, tiered risk. Pulse supports flexible terms, upgrades, and lock/unlock rules to match real-world behavior.

Business Intelligence & Management Reports

From field to finance: visibility that drives action.

Pulse delivers daily performance dashboards, credit portfolio summaries, and payment reconciliation reports — across agents, branches, and regions. Built for operational teams, not analysts.

Developed in the Field

Pulse was built to scale Bboxx.

Now it powers Asopo.

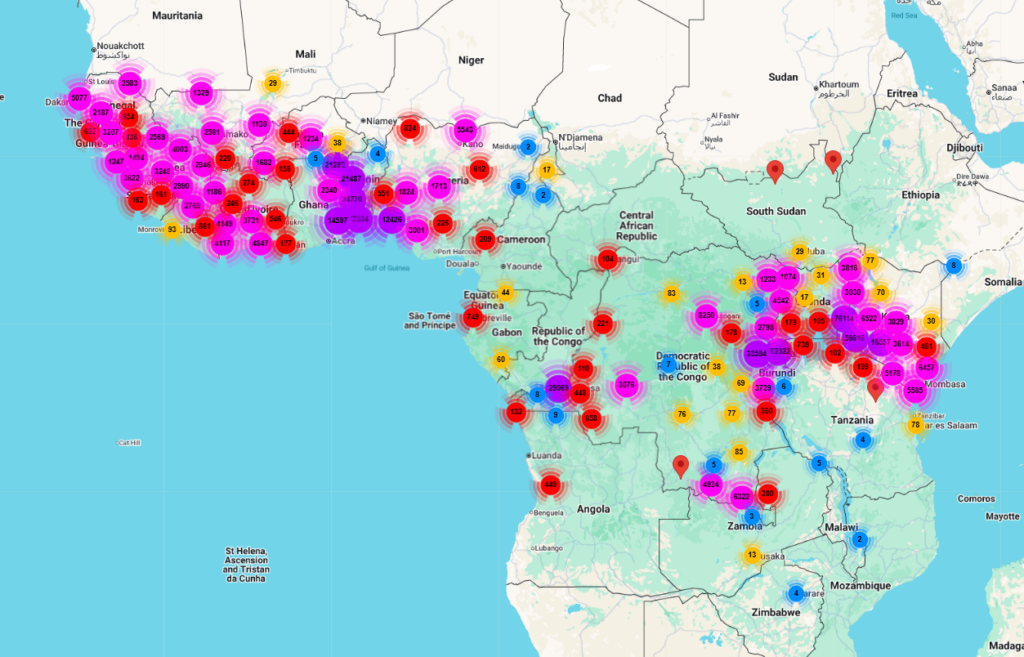

Pulse emerged from over a decade of innovation at Bboxx, supporting clean energy, connectivity, and finance across 10+ countries.

Today, it’s been spun out and commercialized by Asopo Technologies to power Africa’s next generation of distributed infrastructure.

- 6M+ lives improved

- 10K+ active agents

- 100M+ mobile money transactions

- Active in 10+ African countries

- 99.9% platform uptime

- Backed by Abci-Nexus. Proven by Bboxx.

Designed for operators building in the world’s most dynamic economies

flexibility, scalability, reliability

Asset Finance Providers

Powering last-mile credit for phones, solar, e-mobility and beyond.

Distributed Product Businesses

Manage logistics, field ops, and device control at scale and across borders.

Digital Lenders & MFIs

From credit scoring to mobile repayments. Pulse runs your lending engine.

Development Programs & NGOs

Unlock visibility, accountability, and scale for inclusive infrastructure programs.

Leave the tech difficulties to us

WHY PULSE WINS

Modular Architecture

Built as one system. Ready to grow with you.

Scale teams, regions, or products without bottlenecks or rebuilds.

API-first

Connect everything. Lock in nothing.

Pulse integrates cleanly into your ecosystem, no hacks, no rewrites.

Automation & Trigger Engine

Let your system think, and act.

From payment reminders to asset locks, Pulse triggers workflows without human delays.

Offline-Capable Field Stack

Built for the last mile, not just the data center.

Agents work uninterrupted, even without a signal. Syncs when back.

Security & Reliability Built-In

99.9% uptime. Fully traceable. Field-proven.

Pulse is trusted to run core operations across 10+ countries with high availability, strict access control, and full audit trails.

Embedded Intelligence Layer

AI that works, without the data science team.

Credit scoring, fraud signals, customer summaries already built in.